So, you’re ready to buy a home.

Here’s your next 111 to-dos.*

Get Informed – Do Your Research

- Research the real estate industry and legal services to understand what’s available to you, including the entire process and necessity for legal representation.

- Achieve proficiency in federal and state fair housing laws that protect your rights. You want to be sure that you’re not being denied the opportunity to make an offer on a home or secure financing based on your race, religion, national origin, sex, disability, and/or family status.

- Research local and national down payment assistance resources. These programs can help make your home purchase more affordable.

- Check your eligibility for down payment assistance programs.

- If you’re a Veteran, research home services and loan programs available to you.

- If you’re a Veteran, determine whether you qualify for a zero-down VA home loan. Making a down payment is a significant hurdle for many home buyers. Programs like these can open the door to homeownership, for those who know about them and qualify.

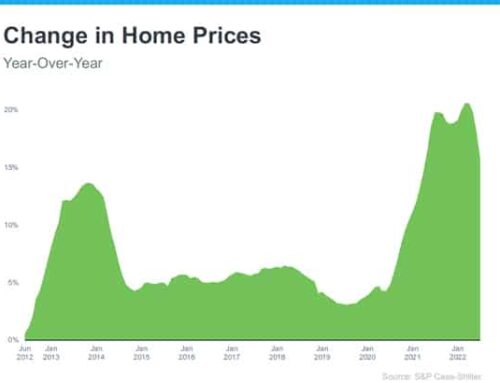

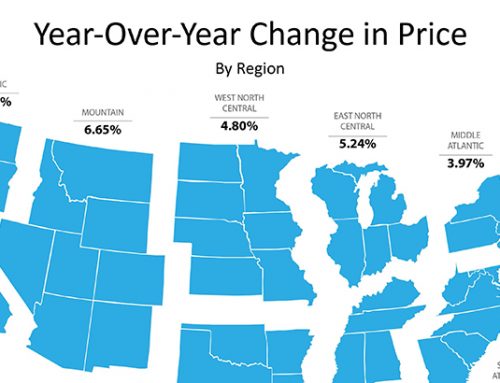

- Learn about local home prices, inventory levels, and market demand in your desired area. If you are in a hotter market, high demand for homes may affect your buying process and offer strategy.

- Ensure that all personal and financial information remains confidential to mitigate risk of identity theft. Research the steps that you can take to protect your identity when buying a home.

- Throughout the process, know the risks of posting home search details on social media to avoid being targeted for fraud.

- Do some research on what home features are currently popular to help identify your preferences and how this may affect the value of the home.

Set Homeownership Goals and Budget

- Obtain a copy of your credit report, including your credit score, to assess where you stand, and ensure you have time to dispute errors and improve your score. The better your credit score, the more likely you are to be approved for a mortgage and receive a better rate.

- Consider all your homeownership wants and non-negotiable needs. You may need a certain number of bedrooms based on the size of your family, or a first-floor bedroom and bathroom if you plan to age in place.

- Set your budget and be mindful of the complete cost of homeownership. Consider the purchase cost of the home and any ongoing living and maintenance expenses. Those ongoing expenses may include but are not limited to real estate taxes, heating, AC, water, yard and appliance maintenance, repairs, homeowners association fees, and commuting costs.

- Assess your financial ability to purchase a home. The typical rule of thumb is that your total monthly housing payment (mortgage, taxes, insurance, etc.) shouldn’t be more than 30% of your gross monthly household income, but individual situations may vary.

- Assess your desired market’s compatibility with your budget based on current income and other considerations.

- Professionally advocate for yourself throughout the entire process. To do that, you should promote and defend your interests while keeping emotions in check to ensure you get your desired outcome.

Start Your Home Search

- Establish and adhere to a schedule for house hunting, mortgage approval, and closing to meet your desired timeline. If you miss any milestone deadlines, you could be at risk of losing your down payment or losing the home for purchase.

- Learn how local markets could affect your buying and owning process. Fewer homes for sale, future development plans, school ratings, access to transportation, and community amenities are all elements that may affect demand in a given market.

- Scout listings and online marketplaces for suitable properties.

- Set up real-time alerts on home search marketplaces to get notifications when matching homes hit the market, and for open houses and price reductions.

- Compare properties to your wants and needs list to ensure they align with what you’re looking for.

- Tap your personal network to uncover additional properties of interest that are not yet publicly listed and may become available for sale soon.

- Contact homeowners in desired areas to see if they are considering selling.

- Gather information about any homes that might be for sale but are not actively being marketed.

- Virtually preview properties that you’re interested in.

- Select homes for viewing that align with your specific needs.

- Schedule multiple in-person home viewings by contacting each home’s listing agent. Schedule separate appointments at times that suit the listing agent but may not always suit you.

- Periodically reevaluate your needs and refocus your property search, as necessary.

- Explore all available resources to learn more about prospective neighborhoods. Be sure to speak to local experts who understand the neighborhood and will give you honest feedback.

- Tour the amenities, schools, and points of interest, and test commute times in your chosen search area.

- Cross-reference local crime registries for the neighborhoods you are searching.

- Educate yourself on what to look for in property disclosures of home listings while you search to make informed decisions. Required property disclosures vary by state and may include, but are not limited to rights of way, upcoming special assessments, whether the home is in a flood zone, past termite damage, and the presence of lead paint.

- Stay current with the listing months of market inventory. As with days on the market, this indicates how competitive a given market is and should inform your offer.

- Consider measures of home value beyond price per square foot. These include neighborhood, proximity to work and community amenities, and community development plans. Be sure to consult with a local expert to get the most comprehensive information.

- Research municipal services and other relevant neighborhood information.

- Be informed about potential neighborhood negatives such as noise levels, venues, or operations that could impact your property value.

- Check applicable zoning and building restrictions if you plan to rent out your home or add a unit to generate short-term or monthly rental income.

- Understand public property and tax information for potential homes. It’s important to be informed about the possibility of future tax increases and property assessments, which will affect the property taxes you owe from year to year.

- Gather and consider important data on utility availability and costs. For example, you’ll want to confirm if the home has good high-speed internet access.

- Research any environmental factors and risks that could affect your home, such as flooding, wildfire, heat, air quality, and noise. Some of these factors will affect the cost of ownership. For example, if the home you purchase is in a flood zone, you will need to obtain flood insurance.

- Narrow down your top home choices for a closer look before considering making any offer.

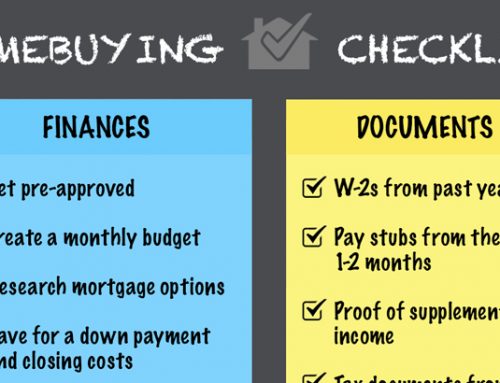

Prepare Financing

- Analyze your finances to determine the total down payment and closing costs you can afford.

- Gather and assess quality lender resources. Ask friends and family for recommendations.

- Consider at least three mortgage lenders during the pre-approval process. Mortgage rates, terms, and eligibility may vary from lender to lender.

- Familiarize yourself with the mortgage pre-approval process. Pre-approval means that a lender has verified your income, credit background, and other factors and has provided a conditional commitment for an approved mortgage amount. With pre-approval, your offer will be considered far more seriously.

- Prepare and collect personal financial information like pay stubs, credit card statements, and other existing loans/debt, and share that information with the lenders you’re considering.

- Collect and compare multiple financing options. Beyond traditional mortgages, look into lesser-known alternative options like seller financing or rent-to-own programs.

- Explore various financing options to find the best fit for your needs. Many people use a conventional, fixed-rate 30-year mortgage, but mortgages with other terms (e.g., 15- and 10-year fixed rate, adjustable rate, and assumable) might also be options.

- Coordinate with your lender to discuss discount points, which you can pay to lower the interest rate on your loan.

- Analyze loan estimates. Loan duration, size of your down payment, fees, and other loan terms can affect your overall mortgage costs.

- Obtain a pre-approval letter from your lender, which is more comprehensive than pre-qualification. Pre-approval is a written commitment from a lender that stipulates the amount they will lend you for a home purchase.

- Carefully review the pre-approval letter from your lender to understand its contents and ask necessary questions.

Making Your Offer

- Review statistics to see what percentage of the list price sellers in your area are currently receiving. This will help you decide whether to offer the asking price, or adjust your offer below or above the asking price, to make your bid more competitive.

- Consider the current, local average days on the market to gauge property pricing and market competitiveness. Fewer days on market indicates greater demand, which means you may need to raise your offer or offer additional incentives to make your offer more competitive.

- Pay for a professional comparative market analysis (CMA) before making an offer to ensure it’s competitive. A CMA is a report that details recent home sales, local market activity, and sales prices to help you craft a successful offer.

- Research independent home valuation information from online resources like Realtor.com to assess an offer price that considers the sale of similar homes in the area. It’s important to make an offer that’s in line with local market conditions. You don’t want to overpay for a home, or make an offer that’s so low it won’t even be considered, so it’s good to talk to an independent adviser who has local market knowledge.

- Consider hiring a real estate lawyer for legal representation as you build your offer and for legal due diligence as you review contractual documentation.

- Review a sample sales contract to prepare to make an offer. This document outlines every facet of the transaction, but it may not include everything you want in the transaction or from the seller, so don’t assume everything is there.

- Understand common contract contingencies and the importance of including protective clauses in your offer. These may include but are not limited to your ability to secure financing that covers the appraised home value, inspections (home, radon, lead, etc.), closing date, date of possession, and owner lease-back terms.

- Learn about any purchasing incentives that you might be eligible for. Home sellers may offer concessions like a pre-paid homeowner warranty, closing costs, or allowance for home improvements/repairs as indicated by a home inspection. You will need to negotiate these as your own representative.

- Ensure your offer will stand out as the most attractive in the current market. Be ready to compete—many homes today are receiving multiple offers and bidding wars are common.

- Craft an offer that is well positioned to be accepted, and submit it to the seller’s agent. An offer typically includes how much you are willing to pay for the home, how much earnest money you can provide, when you want to close on the home, and the deadline for the seller to respond.

Negotiations and Offer Acceptance

- Identify and prioritize your main goals for contract negotiations.

- Familiarize yourself with negotiation best practices. Be mindful of how your body language and facial expressions can influence a successful negotiation.

- Develop a negotiating strategy to secure the best terms. In addition to price, consider terms such as repairs, closing costs, or the timeline for closing.

- Negotiate the best price with the seller’s agent. The seller’s agent will be negotiating on the homeowner’s behalf. You will be negotiating with a professional who likely has extensive experience in this area, and you may be at a disadvantage.

- Be prepared for multiple-offer situations. Don’t get discouraged, and have your negotiation strategies ready.

- Consider using offer strategies like an escalation clause, which raises the price you’re offering by a certain amount over the price that another buyer is offering; offering flexibility on move-in/possession date; or waiving various contingencies.

- Explore optional contingencies, and understand their advantages and disadvantages. If you agree to waive the inspection contingency, for example, you are accepting the risk of purchasing a home that may have myriad defects or require additional funds to repair or bring up to code.

- Be aware that all known material defects should always be disclosed to you. Know what questions to ask, and ensure you receive and comprehend all required disclosure forms by state and federal laws. These forms vary by state.

- Agree to final terms with the seller, and sign the contract. In some states an attorney may be required.

- Verify the final offer is signed by all parties.

- Prepare your lender for listing agent calls. The agent representing the home seller will contact your lender to confirm pre-approval and arrange other settlement details. These details will likely favor the home seller, since that agent is representing their interests, so you may want to participate in those calls to negotiate on your behalf.

Facilitate Closing

- Coordinate communications effectively among all parties, including your lender, the seller’s agent, the closing attorney, and any additional third parties.

- Seek additional guidance for transactions involving short sales, foreclosures, or bank-owned properties. These transactions often involve additional title, ownership, and financing considerations, and they may be as-is —meaning, the properties may be damaged or require costs for repairs that the buyer is accepting as a condition of purchase.

- Estimate the gross out-of-pocket cost of completing the transaction. This may include, but is not limited to, closing costs, a title search, financing points (to “pay down” the mortgage interest rate), and transfer taxes.

- Acquaint yourself with flood insurance. If the home you purchase is in a FEMA-identified flood zone, you must obtain flood insurance as a condition of ownership. You may also consider adding flood insurance to your regular home insurance policy, because most regular policies do not cover damage from flooding.

- Learn about title insurance, and consult a qualified insurance broker. Title insurance covers any pre-existing title problems that you may discover after you’ve purchased the home (e.g., tax liens, unpaid/outstanding mortgages, previous ownership claims).

- Fully investigate your options for a home inspector, title company, appraiser, and other services. Forgoing a home inspection is not advised as these professional inspectors will provide a comprehensive assessment of a home’s current condition and risks.

- Create a list of required and optional home inspections, including environmental, roofing, and mold. This will help you determine what inspection contingencies to include in your purchase offer.

- Ensure that necessary property surveys are ordered. A property survey will help you understand where your property begins and ends, and determine any potential issues—such as easements or encroachments—before you take ownership of the property.

- Discuss any concerns arising from the home inspection. Use any negative findings from your home inspection report as leverage for repairs or credits.

- Track and meet all contract deadlines. Depending on the terms of your offer, these may include deadlines for inspections, final financing/loan, down payment and earnest money deposits into escrow, title searches, and settlement date.

- Order the appraisal. Confirm whether your lender will accept an independent appraiser or require an appraisal management company to conduct the appraisal.

- Question the appraisal report if it affects your financing. Check for errors like square footage, inadequate home comparisons, or incorrect descriptions of the home or neighborhood.

- Order the title search. A clean property title means the buyer and lender agree there are no claims on the property that could become an issue after ownership is transferred.

- Regularly contact your lender to ensure the loan process is on track to meet the closing requirements.

- Ensure any necessary funds, like earnest money or down payments, are received by the stated deadlines to avoid any risk of the seller terminating your contract.

- Ensure all parties have all forms and information needed to close the sale. Missing or late paperwork can cause delays.

- Check addendums and alterations for agreed-upon terms.

- Take note of the location and details of your closing meeting.

- Confirm and communicate the closing date and time to the seller’s agent, noting any changes.

- Schedule and conduct a final property walk-through. Create a comprehensive checklist of your concerns regarding the home, and then confirm that any agreed-upon repairs were addressed or fixed by the seller.

- Confirm the clear-to-close status, indicating all documents and conditions to approve your loan have been met, with your lender.

- Review your closing statement. It explains the terms of the mortgage, the projected monthly payments, and how much your fees and closing costs will be.

- Double-check all taxes, dues, and prorations related to your purchase.

- Request the final closing figures from the closing agent. This is the total amount of money that you will have to bring to the closing table.

- Review your title insurance commitment carefully to ensure all information is accurate.

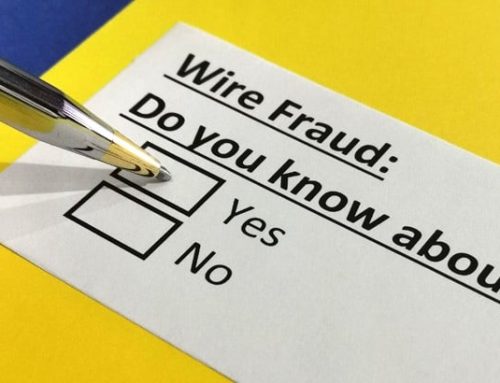

- Be aware of wire fraud risks, and verbally verify all wiring instructions with the seller’s agent before transferring funds. Get the detailed instructions from your closing company, and be leery of any messages you receive that request changes to the original instructions.

- Provide receipt of escrow deposit to the seller’s agent/broker to verify this financial step has been completed.

- Gather all required forms and documents for closing. Typically, you’ll need a photo ID and a cashier’s or certified check (or receipt of a wire transfer).

- Perform any remaining closing activities to complete the transaction.

- Review all closing documents with the closing agent or attorney. Be prepared to sign a ton of paperwork.

- Distribute final documents to all involved parties for their records. You’ll want to keep this important paperwork safe.

- Verify receipt of all keys, access codes, garage door openers, and manuals for all equipment and appliances.

Post-Closing Activities

- Prior to moving, consider rekeying your locks and changing access codes as an extra precaution to safeguard your home from anyone who may have had access prior to your ownership.

- Remember to transfer all utilities and services to your new residence so you do not incur costs on your former residence. This ensures everything is up and running in preparation for your move-in date.

- Turn your home inspection report into a maintenance to-do list.

- File claims with your homeowner’s warranty company as needed. A home warranty is a policy that covers the cost of major repairs or appliances.

- Stay engaged and proactively follow up on any pending items or concerns post-closing. Keep a running checklist handy to ensure you stay on top of any potential warranties, including their expiration dates.

- Arrange for the move-in day in your new home by contacting movers. Buy yourself a bottle of champagne. Congratulations, you’re a new homeowner now.

Or, do 1 thing. Find a buyer’s agent.

No one is better qualified to represent your interests when buying a home than a professional buyer’s agent.

Because they work for you.

They represent your interests in negotiations with the seller’s agent, in probably the biggest financial decision of your life.

Is it any surprise that nearly 9 out of 10** home buyers say they’d use a buyer’s agent when purchasing a home again?

*Actual services or to-dos will depend on the needs of the buyer and the transaction – not all 111 things will need to be done in every transaction.

**Based on a 2023 proprietary survey among recent home buyers and sellers.

Planning to buy? Get your search of homes for sale in Pittsburgh started.

Planning to sell? Download your free home seller’s guide.

Are you relocating to the Pittsburgh area? I can make your move stress-free.

Explore our communities, and then give me a call at (724) 309-1758.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Christa Ross does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Christa Ross will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

![Find Your Dream Home with an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/dreamhome-500x383.png)

![Buying A Home? 7 Reasons To Hire an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/7reasons-500x383.png)

![Your Buyer’s Agent Wears Many Hats [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/manyhats-500x383.jpg)

![Housing Market Forecast for the Rest of 2023 [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2023/08/housingmarketforcast-500x383.jpg)

![Reasons To Sell Your House Today [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2023/05/reasonstosellyourhome-500x383.jpg)

![More Listings Are Coming onto the Market [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2022/06/Morelistings-500x383.jpg)

![Spring Cleaning Checklist for Sellers [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2022/03/infographic-500x383.jpg)

![What’s Causing Today’s Competitive Real Estate Market? [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/10/infographic_competative-500x383.jpg)

![Financial Fundamentals for Homebuyers [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/01/financialfundamental_feature-500x383.jpg)

![Expert Forecast on the 2021 Housing Market [VIDEO]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/01/20210105-KCM-Share-2-500x383.jpg)

![Where Is the Housing Market Headed for the Rest of 2020? [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/08/20200730-MEM-1380x2048-1-500x383.jpg)

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/04/housingrecession-500x383.jpg)

![What You Can Do to Get Your House Ready to Sell [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/04/housereadytosell-500x383.jpg)

![10 Steps to Buying a Home This Summer [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/07/10stepstobuying_feature-500x383.jpg)

![4 Reasons to Sell This Summer [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/06/4Reasons_KCM-500x383.jpg)

![5 Reasons Why Millennials Buy a Home [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/04/Millennials-Choose-to-Buy-ENG-MEM1-1046x1354-500x383.jpg)

![Existing Home Sales Slow to Start Spring [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/04/existinghomesale-500x383.jpg)